Dividing home care costs and responsibilities without upsetting the family to assist Mom and Dad as they age can be tricky. Especially if siblings have divergent incomes or some live closer to their parents than the others.

It sounds like a simple scenario: Mom and Dad need home care, so it’s time to convene your brothers and sisters to work out a way for all of you to contribute their fair share. However, splitting caregiving costs and responsibilities are anything but simple. In fact, trying to figure out how to do it can lead to plenty of frustration.

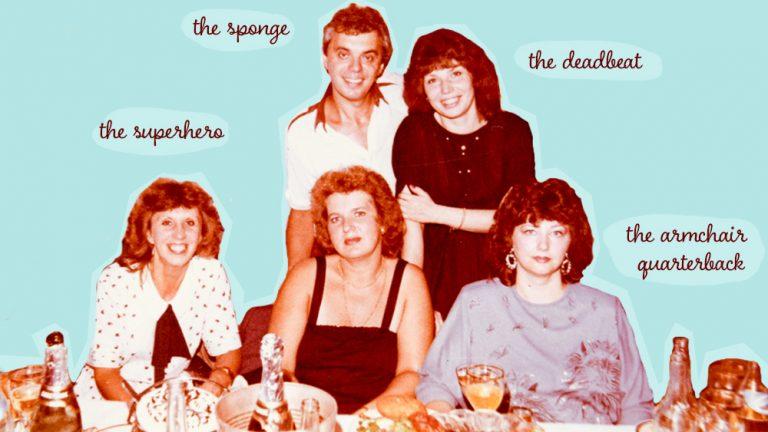

What a family member considers ‘fair’ is likely dictated from that family member’s perspective, and family members can make persuasive arguments that are contradictory from a financial perspective. Expect to deal with issues ranging from distribution of labor (“I took Dad and Mom in to live with me”) to parental favoritism (“Dad always loved you more”) as rationales for why one sibling should contribute more or less than another. Perhaps the most important rule in splitting caregiving costs is this: Put family harmony at the top of your priority list. Parents want to know the family is going to remain intact after they’re gone.

Despite the potential obstacles, you can try to reach consensus to shore up Mom and Dad’s finances without ruining your sibling relationships by following these tips:

Start by seeking professional advice.

An attorney or financial planner who specializes in elder issues can help you put family baggage aside to achieve consensus. As important, one of these professionals will know how to structure financial documents properly to avoid any legal issues that may arise.

Use Mom and Dad’s money first.

Generally, if it’s the parents’ expense and they have the funds, they should pay first, before tapping into children’s funds. Doing so will be especially important if the parent wants to receive Medicaid payments for caregiving costs in the future.

If sibling incomes vary widely, go the percentage route.

Have your brothers and sisters contribute a percentage of their incomes based on their financial situations, so ones who are less well-off won’t be expected to shoulder more than they can manage.

Factor in the amount of time each sibling dedicates to caregiving.

When one child lives close to the parents and provides most of the actual caregiving, consider assigning a monetary value to that time investment then reduce his or her financial share accordingly. You may use an hourly rate comparable to that charged by an in-home caregiving agency. The national average is between $25-$30 per hour for private pay caregivers depending on where you live.

Put in all down in writing. For a straightforward agreement list the following: each sibling contributing a monthly amount, all you’ll need is a simple business partnership agreement with the details of how much each family member will contribute.

*If you have any questions on how to divide home care costs and responsibilities without upsetting the family and to learn more about private home care costs please give us a call at Elder Home Care – we are happy to assist.